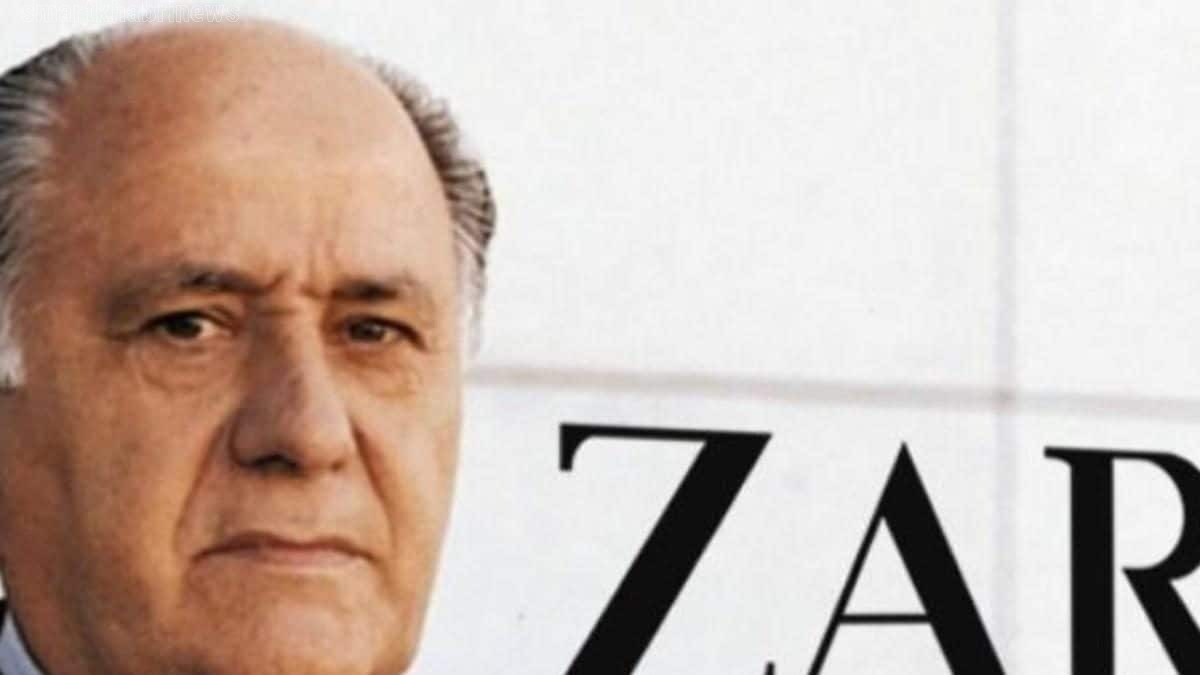

Amancio Ortega, the Spanish billionaire and visionary behind Zara, has recently made a significant addition to his burgeoning real estate holdings in the United States. His family firm, Pontegadea, successfully purchased 727 West Madison, a prominent luxury apartment building in Chicago, for an impressive $232 million. The acquisition was confirmed by a spokesperson for the company and marks yet another milestone in Ortega’s strategic property investments.

Expanding US Property Holdings

Pontegadea’s acquisition of 727 West Madison from a joint venture between Ares Management and F&F Realty showcases Ortega’s continued interest in the US real estate market. This 45-story luxury building now stands among his remarkable collection of high-profile properties across the United States. Notable holdings include the headquarters of Meta Platforms Inc. in Seattle and the iconic Haughwout building in Manhattan.

Luxurious Features and Rental Prices

The distinctive circular tower of 727 West Madison is home to 492 upscale apartments, offering a range of luxurious amenities. Monthly rental prices vary, starting around $2,200 for a studio apartment, and going up to $6,000 for a spacious three-bedroom flat. This diversity of options caters to a range of individuals seeking refined living spaces in a prime Chicago location.

A Strategic Sales Endeavor

Jones Lang LaSalle Inc (JLL), a renowned provider of real estate and investment management services, was entrusted with the sale of this skyscraper located in Chicago’s trendy West Loop neighborhood. The building’s prime location, in proximity to Google’s headquarters, added to its appeal. Originally projected to yield $250 million, the sale was a notable achievement in the dynamic real estate market.

Ortega’s Financial Profile

According to the Bloomberg Billionaires Index, Amancio Ortega’s net worth stands at an impressive $75 billion. The majority of his wealth is derived from his significant stake in the Spanish clothing company Inditex SA, which includes the globally recognized brand Zara. Additionally, his property holdings were valued at €18.1 billion ($19.7 billion) the previous year, underscoring the substantial diversity of his investments.

Diversification Beyond Borders

In a notable shift from his traditional focus on landmark office and retail spaces, Ortega spent nearly $1 billion in the previous year on the acquisition of US warehouses. This strategic diversification aligns with his broader investment strategy. Pontegadea’s recent acquisitions extend beyond the US and encompass various real estate assets, including a logistics hub near Los Angeles, a warehouse in the Netherlands, and an office building in central London.

The Real Deal magazine has previously reported on the acquisition of 727 West Madison, shedding light on the trajectory of Ortega’s expanding property empire.

A Holistic Investment Approach

Beyond real estate, Pontegadea, Ortega’s family firm, has established investments in energy, communication infrastructure providers, and renewable energy sources. Notable holdings include REN—Redes Energeticas Nacionais SGPS, a Portuguese power and gas grid operator, and Redeia Corporacion SA, a Spanish electricity transporter. This diversified investment strategy aligns with Ortega’s forward-looking approach to business.

International Expansion

March brought a significant milestone for Pontegadea, as Ortega’s private corporation made its first non-US real estate acquisition. A premium residential complex comprising 120 rental flats in Dublin, Ireland, was acquired for approximately 100 million euros ($108 million). This investment marked Pontegadea’s commitment to expanding its real estate assets internationally and embracing a spectrum of property opportunities.

A Luxurious Offering in Dublin

The acquired property, known as Opus 6 Hanover Quay, is situated in the heart of Dublin’s Silicon Docks. This thriving commercial and technology hub provides an ideal location for the luxurious flats and townhouses available for long-term rent. Pontegadea’s entry into the Dublin market signifies its proactive stance in pursuing diversified and lucrative real estate ventures.