According to the latest figures from the Office for National Statistics (ONS), the rate of inflation has significantly eased, falling to single digits for the first time since last summer, reaching 8.7% last month. However, while this is a positive development, food inflation remains high at nearly 20%, and core price inflation has reached a 30-year peak.

| Category | Inflation Rate – April | Inflation Rate – March |

|---|---|---|

| Overall CPI | 8.7% | N/A |

| Food Inflation | 19.1% | 19.2% |

| Core Inflation | 6.8% | 6.2% |

Please note that the table includes the inflation rates for overall CPI, food inflation, and core inflation for both April and March.

The main driver behind the decline in the consumer prices index measure (CPI), as highlighted by the ONS, is the stability in gas and electricity costs during April, compared to the unprecedented surge witnessed in the same month last year. In April 2022, the energy price cap was raised by 54% to £1,971, reflecting the impact of the conflict in Ukraine on European energy supplies.

Since the invasion and subsequent events, energy costs have been a major contributor to the cost of living crisis. Not only have household energy bills been affected, but manufacturing and transport prices have also been influenced, with repercussions throughout the economy.

Despite the slower pace of price increases, the decline was not as pronounced as anticipated by economists polled by Reuters and the Bank of England. Economists had predicted a rate of 8.2%, while the Bank had expected 8.4%.

Unfortunately, there is little relief for households as earnings continue to lag behind the rate of price rises. Although inflation has eased, it does not imply that prices are decreasing; they are still on the rise.

Food inflation, in particular, stood at 19.1% in April, slightly lower than March’s figure of 19.2%. To tackle the upward pressure on prices and dampen demand in the economy, the Bank of England has been implementing interest rate hikes.

The International Monetary Fund (IMF), in its latest assessment of the UK economy, suggests that further rate increases are necessary. The IMF has significantly upgraded its expectations for economic growth.

The Bank of England is concerned about stubborn core inflation, which excludes volatile elements such as fuel and food. Last month, the core inflation rate rose to 6.8%, the highest since 1992, up from 6.2% in March, defying expectations of stability.

There is also apprehension among rate-setters that pay awards aimed at combating inflation may inadvertently fuel further price growth.

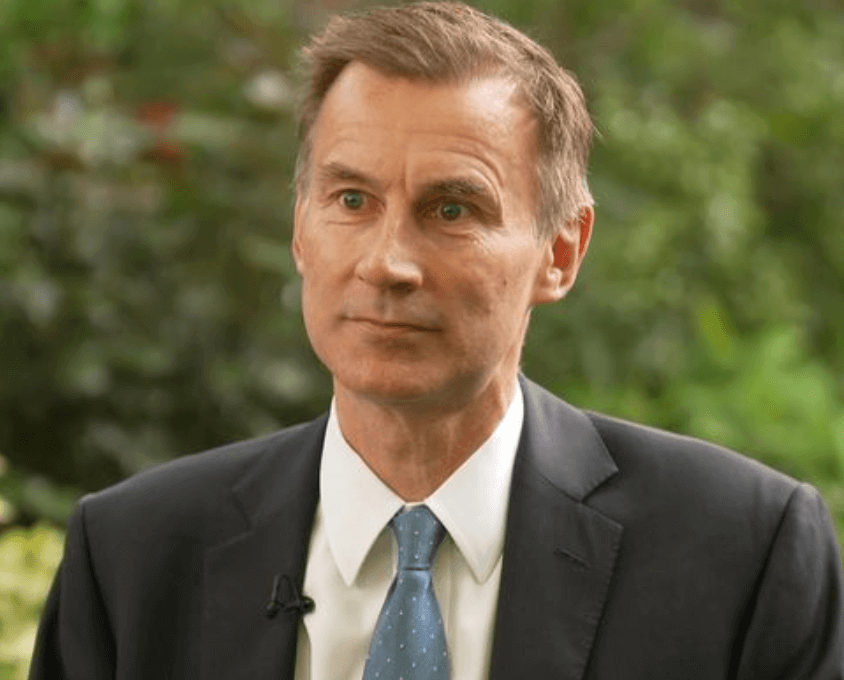

Chancellor Jeremy Hunt commented, “The IMF acknowledged yesterday that we have taken decisive action to tackle inflation. While it is positive that inflation is now in single digits, food prices continue to rise at an alarming rate. Therefore, we must remain resolute in our plan to reduce inflation, in addition to providing around £3,000 of cost-of-living support to families this year and last.”

Economists anticipate a further easing of the inflation rate as the year progresses, aligning with the government’s target to halve inflation. However, risks remain due to ongoing energy supply constraints, particularly during the upcoming winter months.

A recent forecast by Pantheon Macroeconomics suggests that CPI inflation is likely to stabilize this month, slow to 7.3% in June, and reach 3.3% by December. These projections reflect the decline in wholesale energy costs observed throughout this year compared to the price surge experienced in 2022.

On Thursday, energy regulator Ofgem is expected to announce a reduction in the price cap to £2,053 per year for the July to September period. This decrease follows the previous cap level of £3,280 set for March to June, which became largely irrelevant due to the government’s Energy Price Guarantee that was in place until the end of June.